When Britain’s new prime minister, Jeremy Hunt, last week reversed most of his predecessor’s damaging ‘mini’ budget measures, he was still facing a fiscal gap of over £40bn a year. .

He warned that incorporating this into the Halloween financial statement would require “tearfully difficult decisions.”

But just over a week later, Hunt’s measures, along with his promise of prudent finances and the appointment of a new prime minister, have put finances at ease. market And it delivered what some in the city call a “sluggishness dividend”: lower long-term borrowing costs.

This allowed Prime Minister Rishi Sunak and the prime minister to postpone the autumn statement until 17 November. little market response.

The delay also improved fiscal prospects by allowing the Office of Budget Responsibility, the fiscal watchdog, to take into account lower government borrowing costs. It could be less than £10bn a year, but the savings are significant.

But with the cost of repaying the government debt much higher than at the time of the spring statement and the economic outlook dimming, none of the decisions he and the prime minister will take will be easy.

with snacks hunt We also have to deal with the fact that spending cuts and tax increases will dampen growth prospects and reduce government revenue prospects. This means that whatever the size of the accounting hole, the repair work will inevitably be large.

Sunak on Wednesday said he was willing to make risky decisions to close the gap, leaving the possibility of abandoning the totem ‘pension triple lock’ that would guarantee national pensions to rise by at least 2.5% a year. showed. Higher than earnings growth or inflation in hopes of improving economic prospects ahead of elections expected in 2024.

But before the new prime minister considers going to the country, he needs to prove that the finances have stabilized on 17 November.

This task will be easier than it was with the October 31st announcement. This is because the OBR will no longer need to base its projections of government debt service costs on the very high financial market prices that prevailed in early to mid-October.

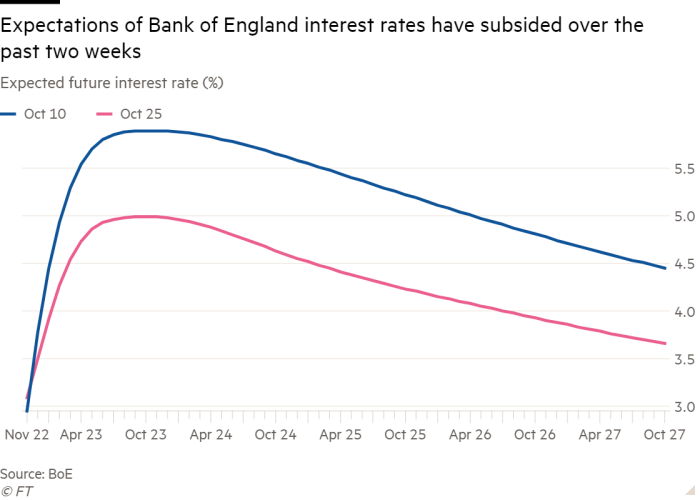

At the time, the Bank of England’s interest rate forecast surged, reaching around 6% on 10th October. Now he’s peaking at just under 5%.

Interest rates on government bonds, which set the government’s borrowing costs, also fell from 4.7% to less than 4% for 14-year bonds, the average duration of UK government bonds.

The decline in bond yields from their peak on 10 October could have improved the fiscal outlook by £14bn a year if the OBR had been based on its initial projections of the day. However, the improvement is expected to be small.

Government sources have suggested that the OBR’s estimate of financial troubles this week will be closer to £30bn a year, compared to last week’s £35bn to £40bn a year black hole. watchdog.

Sunak acknowledged on Wednesday that decisions on taxes and spending remain “difficult” even with a small fiscal hole. Officials now worry that some of the money saved on paper will quickly disappear in forecasts of poor economic performance whenever they propose spending cuts or tax increases.

This means that ministers are likely to be advised in their autumn statement that they should seek annual savings totaling nearly £40bn, which is still a significant amount.

Some savings options look solid. The government will likely freeze foreign aid to his 0.5% of gross domestic product and will not raise it to the previously planned 0.7%. This will save £5 billion a year.

The appointment of Andrew Mitchell, an advocate for increasing aid spending, as development minister should limit the risk of a Tory insurgency on the issue. Mitchell tells his colleagues that his 0.5% of GDP is a realistic target given the circumstances.

Income tax thresholds and benefits are also covered. A person briefed on Mr. Hunt’s thinking said it would be frozen until the end of the five-year forecast period, and that higher inflation would increase or drive more people to join the income tax system for the first time, thus making it “stealth.” could raise £5 billion a year by Take them to a higher band.

Wednesday’s Sunak also left room for benefits and pensions to rise at a slower pace than next April’s inflation rate.

“I have always acted to protect the most vulnerable because that is what is right and that is the value of our Compassionate Party.”

But protecting vulnerable people means well below £10 billion a year in benefits costs.

Other potentially big savings include lowering projected public spending growth beyond 2024-2025, when existing plans expire. A 1 percentage point reduction in spending growth would save £13 billion a year.

Reducing capital expenditures could save us up to another £10bn a year, but we would be able to sustain our spending at virtually any point in the last 30 years.

Hunt hopes that stabilizing the market will buy him time and that market prices will improve further, but the government’s outlook is far more bleak than it appeared in the spring.

The fall statement may be delayed from Halloween, but it could scare many voters and Conservative MPs when it’s delivered next month.

https://www.ft.com/content/1dc057df-2ef0-47fa-bd40-3f5d229b0cff UK finance moves from ‘dumb premium’ to ‘dull dividend’